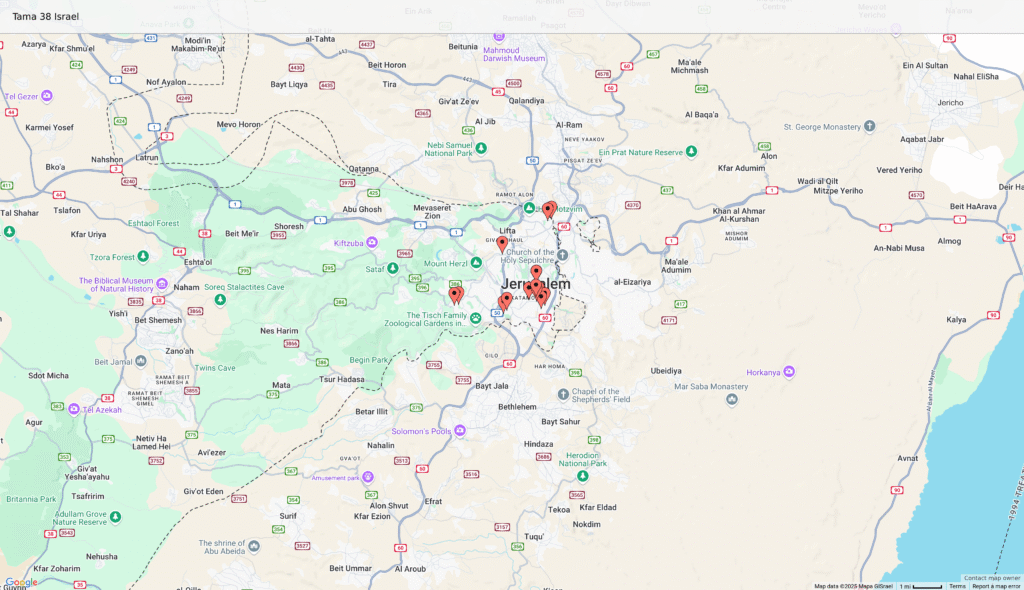

View full screen map

Introduction

Jerusalem, a city that seamlessly blends historical significance with modern development, has been witnessing a remarkable transformation through Tama 38 projects. As Israel’s capital continues to grow, these urban renewal initiatives have become essential in addressing the dual challenges of earthquake preparedness and housing shortages. With over 70% of Jerusalem’s buildings constructed before 1980 and many not meeting current seismic standards, Tama 38 represents not just a business opportunity but a crucial safety upgrade for the city of nearly 1 million residents. This blog explores the impact of Tama 38 in Jerusalem, highlighting key neighborhoods, successful projects, and investment opportunities for those looking to enter this dynamic market where property values have appreciated by approximately 40% over the past five years.

Understanding Tama 38: The Regulatory Framework and Economic Benefits

Tama 38 (National Outline Plan 38) was initially introduced by the Israeli government in 2005 as a response to the urgent need for earthquake reinforcement in older buildings, particularly following the sobering lessons from the 1999 İzmit earthquake in neighboring Turkey. The program offers significant incentives to property owners and developers who upgrade existing structures to meet current seismic standards, essentially creating a win-win-win situation for residents, developers, and the broader urban fabric.

The Economic Mechanics of Tama 38

The financial model that makes Tama 38 viable operates on a unique principle: developers receive building rights to construct additional units (typically 1.5-3 times the size of a typical floor in the existing building), which they can sell on the open market. In exchange, they bear the costs of:

- Structural reinforcement (estimated at ₪200,000-400,000 per existing apartment)

- Addition of secure rooms (Mamad) to each existing unit (valued at ₪120,000-180,000 per unit)

- Installation of elevators (approximately ₪350,000-500,000 per building)

- Renovation of common areas and facades (₪150,000-300,000 depending on building size)

- Expansion of existing apartments by 12-25 square meters per unit

In Jerusalem’s premium neighborhoods, this equation becomes particularly attractive as new apartments can sell for ₪35,000-60,000 per square meter, creating substantial profit margins even after accounting for construction costs of ₪10,000-15,000 per square meter.

The Two Implementation Paths

There are two main versions of Tama 38, each with distinct advantages in different contexts:

- Tama 38/1 (Reinforcement and Addition):

- This involves strengthening the existing building’s foundation and structural elements

- Adding protected spaces (Mamad) to each apartment (typically 12 sqm)

- Installing modern elevators and systems

- Renovating common areas and building envelope

- Constructing 1-3 additional floors on top of the current structure

- Average project timeline: 18-24 months from construction start

- Typical Jerusalem example: A 4-story building in Rehavia becomes a 6-7 story modern structure with the original residents remaining in place during most of the construction

- Tama 38/2 (Demolition and Reconstruction):

- Complete demolition of the old building

- Construction of an entirely new structure with 2.5-3 times the original built area

- Residents receive brand new apartments 25-35% larger than their original units

- Developers typically build 12-25 new units for every 10 original apartments

- Average project timeline: 30-36 months with temporary resident relocation

- Typical Jerusalem example: An aging 3-4 story building in Kiryat HaYovel is replaced with a modern 8-9 story building with underground parking

Tama 38 Evolution and Current Status

While the original Tama 38 program was scheduled to end in October 2022, the Jerusalem Municipality, recognizing the program’s success, has implemented a modified continuation policy. Under Jerusalem Local Plan 101-0465229, projects that had submitted initial applications by December 2021 can still proceed. Additionally, many projects now continue under alternative frameworks such as “Pinui-Binui Light” or through Special Local Plans (Tochnit Nekudat Tichnonit). As of early 2025, over 150 Tama 38 projects remain in various approval stages across Jerusalem, demonstrating the enduring relevance of this development model.

Why Jerusalem is a Tama 38 Hotspot: Market Analysis and Demographic Factors

Jerusalem presents unique opportunities for Tama 38 projects for several compelling reasons, supported by market data and demographic trends:

- Aging Housing Stock: Approximately 65% of Jerusalem’s residential buildings were constructed before 1980, with over 42,000 units built during the 1950s-1970s construction boom. These buildings typically lack modern amenities, earthquake protection, and secure rooms (Mamad), creating an urgent need for upgrading. According to the Jerusalem Institute for Policy Research, roughly 28% of the city’s housing stock requires significant structural reinforcement.

- Premium on Renovated Properties: Market analysis from 2023-2024 reveals a substantial price gap between unrenovated and renovated apartments:

- Unrenovated 3-room apartments in central Jerusalem: ₪1.8-2.5 million

- Post-Tama 38 renovated equivalent units: ₪3.2-4.0 million

- This 45-60% price premium makes the economic model highly attractive for developers

- Land Scarcity and Density Challenges: Jerusalem’s unique topography, historical preservation zones, and geopolitical complexities have created severe land shortages. With buildable land prices exceeding ₪15,000 per potential built square meter in central areas, the municipal master plan specifically identifies urban renewal as providing 40% of new housing solutions through 2030.

- Proactive Municipal Policies: The Jerusalem Municipality has established dedicated departments for urban renewal:

- The Jerusalem Urban Renewal Authority (established 2018) provides expedited processing for Tama 38 applications

- Special tax incentives including 25-year betterment tax exemptions for qualifying projects

- Reduction of permit fees up to 50% for projects in priority neighborhoods

- Technical assistance programs for residents considering Tama 38 proposals

- Demographic Pressure: Jerusalem’s population is projected to reach 1.25 million by 2040, requiring approximately 5,000 new housing units annually. With only about 3,000 units being built through conventional development, urban renewal must bridge the gap, as outlined in the Jerusalem Strategic Housing Plan 2025-2040.

- International Investment: Jerusalem’s global significance attracts foreign investors, particularly from France, the United States, and the United Kingdom. International buyers represent approximately 15-20% of purchases in premium Tama 38 projects, especially in neighborhoods like Rehavia, German Colony, and Baka, where they often pay 10-15% premiums for renovated properties with modern security features.

Key Jerusalem Neighborhoods for Tama 38 Projects: Detailed Market Analysis

Rehavia and Talbieh: Premium Central Districts

These prestigious central neighborhoods represent Jerusalem’s luxury Tama 38 market, with notable characteristics:

- Property Value Metrics: Pre-renovation apartments: ₪32,000-38,000/sqm; Post-Tama 38: ₪48,000-65,000/sqm

- Project Economics: Developer profit margins typically 22-28% despite higher acquisition costs

- Architectural Considerations: Conservation restrictions apply to approximately 35% of buildings, requiring preservation of distinctive Bauhaus and Eclectic style elements

- Notable Projects:

- Diskin 12-14: Added 2 floors to a 1940s structure while preserving the original façade, creating 8 new luxury units selling at ₪60,000/sqm

- Ramban 25: Complete demolition and reconstruction (Tama 38/2) creating a boutique building with 24 units, including 9 premium penthouses with Old City views

- Current Activity: As of early 2025, 27 active Tama 38 projects in various stages of approval/construction

- Market Dynamics: Average time from listing to sale for new Tama 38 units: 3.5 months, compared to Jerusalem average of 6.2 months

German Colony and Greek Colony: Heritage Zones with Premium Potential

Known for their unique character and proximity to cultural attractions, these southern Jerusalem neighborhoods have specialized Tama 38 characteristics:

- Property Value Range: Pre-renovation: ₪30,000-35,000/sqm; Post-Tama 38: ₪42,000-55,000/sqm

- Heritage Protection: The Jerusalem Historic Buildings Preservation Committee requires review for approximately 60% of potential projects

- Typical Project Structure: 70% utilize Tama 38/1 (reinforcement) due to heritage value of existing structures

- Case Study: Emek Refaim 52 project preserved the historic Templar façade while completely reconstructing the interior, creating 6 luxury apartments and 2 garden units that sold out in pre-construction phase at ₪52,000/sqm

- Target Demographics: 40% of buyers are international investors or second-home purchasers, particularly from French and North American markets

- Current Planning Status: The German Colony Local Master Plan (2022) designated specific “Tama 38 priority zones” allowing for expedited approval on streets like Yehoshua Bin-Nun and Rabbi Akiva

Baka and Arnona: Family-Focused Mid-Premium Markets

These southern neighborhoods present a balanced opportunity with excellent community facilities:

- Property Value Metrics: Pre-renovation: ₪26,000-32,000/sqm; Post-Tama 38: ₪38,000-45,000/sqm

- Housing Stock Profile: 63% of buildings constructed 1955-1975, with typical 3-4 story structures on 500-800 sqm lots

- Project Economics: Average developer investment: ₪2.7-4.5 million per project beyond construction costs

- Notable Developments:

- Yehuda Street Cluster: Group of 5 adjacent buildings implementing coordinated Tama 38/2 projects, creating shared underground parking and garden areas

- Gideon Street 14-16: Mixed-use development combining Tama 38 with ground floor commercial spaces

- Target Market: 70% primary residences for local Jerusalem families, 30% investors

- Municipal Incentives: Special height allowances (up to 2 extra floors beyond standard Tama 38 rights) in designated “urban intensification zones” near the light rail

Kiryat HaYovel and Kiryat Menachem: Value Markets with Transformation Potential

These southwestern neighborhoods demonstrate Tama 38’s ability to transform more affordable areas:

- Property Value Range: Pre-renovation: ₪18,000-22,000/sqm; Post-Tama 38: ₪28,000-32,000/sqm

- Housing Stock Characteristics: Large inventory of identical 3-4 story “shikunim” (public housing blocks) from the 1950s-60s ideal for standardized Tama 38/2 approaches

- Economic Appeal: Highest percentage return on investment among Jerusalem neighborhoods (55-65% value increase post-renovation)

- Scale Advantage: Opportunity for multi-building projects covering entire street blocks

- Case Study: Stern Street Renewal Project – Comprehensive renewal of 12 buildings with 216 original units transformed into 380 modern apartments, including the addition of commercial spaces and public plazas

- Municipal Support: Designated as “Priority Urban Renewal Zone” with expedited approvals and increased building rights

- Financial Incentives: Additional construction rights of up to 3.5 times the original building area (versus standard 2.5x) in specifically designated zones

Ramat Eshkol and French Hill: Emerging Tama 38 Frontiers

These northern neighborhoods, developed after 1967, represent the “second wave” of Tama 38 opportunities:

- Property Value Metrics: Pre-renovation: ₪22,000-28,000/sqm; Post-Tama 38: ₪32,000-38,000/sqm

- Strategic Advantages: Proximity to Hebrew University and Hadassah Medical Center creates steady rental demand

- Current Activity Status: 18 projects in planning stages, 7 under construction as of Q1 2025

- Technical Considerations: Many buildings constructed with higher seismic standards requiring less structural intervention

- Investment Profile: Lower acquisition costs but slightly smaller margins (18-22%) compared to central neighborhoods

- Market Dynamics: Strong appeal to young professionals and academic staff, with 40% of new units purchased as investment properties

- Future Growth Catalysts: Planned light rail extensions and the expansion of business districts nearby are expected to drive 15-20% additional property value growth through 2030

Notable Success Stories: Tama 38 Projects in Jerusalem – Case Studies and Market Impact

The Rehavia Renaissance: Luxury Transformation Case Studies

The central neighborhood of Rehavia has become a showcase for premium Tama 38 implementations, with several landmark projects demonstrating the highest standards of execution:

Keren Hayesod 38-40 Complex

Project Profile:

- Developer: Hadas Construction Group

- Original Building: 1938 Bauhaus structure, 3 floors, 12 units (60-75 sqm each)

- Project Type: Tama 38/1 (reinforcement with additions)

- Project Timeline: 26 months (completed 2023)

- Project Outcomes:

- Original structure preserved and reinforced with advanced seismic systems

- Two additional floors added with setbacks to maintain architectural proportions

- 8 new premium units (110-180 sqm) with selling prices of ₪53,000-58,000/sqm

- Original residents received 25 sqm expansions, secure rooms, and new balconies

- Complete infrastructure modernization including smart building systems

- Jerusalem Heritage Preservation Award winner (2023)

Ramban Street Corridor Development

Project Profile:

- Developer Consortium: Jerusalem Urban Renewal Partners

- Scale: Coordinated renovation of 5 adjacent buildings (Ramban 32-42)

- Project Type: Mixed Tama 38/1 and 38/2 approaches

- Investment: ₪175 million total project cost

- Implementation Strategy:

- Phased development allowing synchronized construction schedules

- Shared underground parking facility (85 spaces) through special municipal variance

- Unified architectural language across all buildings while preserving historic elements

- Creation of shared central courtyard with public access during daytime hours

- Integration of rainwater harvesting and solar energy systems across all structures

- Market Impact: Created a new premium micro-neighborhood with 35% property value increase in surrounding buildings

German Colony Heritage Integration: Balancing Preservation and Modernization

The German Colony’s unique historical character has spawned specialized Tama 38 approaches that have been recognized for their sensitive integration of heritage elements:

Emek Refaim 46-48 “The Templar Houses”

Project Profile:

- Developer: Historic Jerusalem Development Ltd.

- Original Structure: 1890s Templar houses with 1950s additions

- Project Challenge: Heritage preservation requirements for facades and certain interior elements

- Implementation Approach:

- Surgical reinforcement of historic stone facades

- Complete reconstruction of interiors with modern structural standards

- Addition of one recessed floor barely visible from street level

- Integration of original architectural elements including stone arches and woodwork

- Underground excavation to add parking without altering the historic street appearance

- Economic Outcomes:

- Project cost premium of 35% over standard Tama 38 due to preservation requirements

- Compensated by 42% price premium for “authentic heritage” units

- 100% pre-completion sales despite premium pricing (₪55,000-60,000/sqm)

Elazar HaModa’i Street Boutique Collection

Project Profile:

- Developer: Jerusalem Renewal Group

- Project Concept: Creation of integrated collection of 4 renovated heritage buildings

- Technical Innovation:

- First Jerusalem implementation of “box-in-box” structural reinforcement allowing complete preservation of exteriors

- Custom-designed seismic dampers concealed within historical structural elements

- Smart home systems integrated without visible modern elements in public spaces

- Marketing Strategy: Positioned as “living heritage” with emphasis on historical authenticity combined with modern safety and convenience

- Market Performance: Created highest price per square meter in neighborhood history (₪62,000/sqm for penthouse units)

Kiryat HaYovel Transformation: Large-Scale Urban Renewal Impact

This southwestern neighborhood has demonstrated how Tama 38 can drive comprehensive neighborhood revitalization:

Brazil Street Mega-Project

Project Profile:

- Developer Consortium: Jerusalem Community Renewal Initiative

- Scale: Entire street section (8 buildings, 144 original units)

- Project Type: Tama 38/2 (complete demolition and reconstruction)

- Project Economics:

- Original building value: ~₪16,000/sqm

- New construction cost: ~₪11,000/sqm

- New unit market value: ~₪30,000/sqm

- Developer margin: 22% (below central neighborhood margins but with higher volume)

- Community Impact Metrics:

- Creation of 240 new housing units (67% increase in density)

- Addition of 2,200 sqm of public space and playgrounds

- New commercial street front with 18 small business spaces

- 35% energy consumption reduction through modern building standards

- Improved neighborhood demographic mix with 30% of new units purchased by young families

Borochov Quarter Regeneration

Project Profile:

- Public-Private Partnership: Jerusalem Municipality with three development companies

- Implementation Model: Coordinated Tama 38/2 projects with integrated public space master plan

- Project Components:

- Demolition and reconstruction of 22 aging buildings

- Creation of continuous green corridor connecting reconstructed buildings

- Infrastructure upgrades including underground power lines and fiber optic network

- Addition of community facilities including daycare center and senior activities space

- Economic Revitalization Indicators:

- 40% increase in local business revenue following project completion

- 55% reduction in crime rates in project area

- Property value increase extending to non-renovated buildings (15-20% “halo effect”)

- Transformation from negative to positive migration balance for young families

These case studies demonstrate how Tama 38, when executed with vision and attention to both physical and community infrastructure, can transform not just individual buildings but entire urban fabrics. The Jerusalem model of implementation has become a reference point for other Israeli municipalities seeking to maximize the urban renewal potential of their aging neighborhoods.

Investment Considerations for Tama 38 in Jerusalem: Detailed Financial Analysis and Risk Assessment

Comprehensive Financial Structure Analysis

Investors approaching Jerusalem’s Tama 38 market should understand the sophisticated financial mechanisms and capital requirements involved:

Capital Requirements Breakdown

- Project Acquisition Costs:

- Land Assembly/Rights Purchase: ₪1.5-8 million depending on neighborhood and building size

- Preliminary Engineering and Feasibility Studies: ₪150,000-300,000

- Legal Structure and Resident Agreements: ₪200,000-450,000

- Initial Planning and Municipality Submissions: ₪180,000-350,000

- Development Phase Capital Requirements:

- Construction Financing: Typically 70-75% LTV from financial institutions at 5-7% interest rates

- Equity Requirements: 25-30% of total project costs required from developers/investors

- Cash Flow Management: Critical financing gap during years 1-2 before pre-sales can be leveraged

- Financing Structures: Most Jerusalem developers utilize either:

- Closed project financing (higher interest but fixed terms)

- Mezzanine financing with equity participation for larger projects

- International investor syndication (particularly common in premium neighborhoods)

- Detailed Project Economics – Typical Jerusalem Case Study:

- Original Building: 8 units of 75 sqm each (600 sqm total)

- Project Additions: 12 new units averaging 100 sqm each (1,200 sqm)

- Construction Costs: ₪13,000/sqm (₪15.6 million total)

- Existing Owner Compensation: ₪1.2 million in renovations and expansions per unit (₪9.6 million)

- Soft Costs: ₪4.8 million (planning, legal, financing, marketing)

- Total Investment: ₪30 million

- Revenue From New Units: ₪40,000/sqm × 1,200 sqm = ₪48 million

- Project Return: ₪18 million profit (37.5% gross margin, 22% net ROI over 3-4 year timeline)

Project Timeline and Capital Deployment Schedule

Understanding the extended Tama 38 timeline is critical for proper investment planning:

Phase-by-Phase Timeline:

- Pre-Development (8-14 months):

- Resident assembly and initial agreements (2-4 months)

- Engineering feasibility studies (1-2 months)

- Preliminary architectural planning (2-3 months)

- Municipality pre-approval process (3-5 months)

- Capital Deployed: 15-20% of total investment

- Planning and Approvals (10-16 months):

- Detailed architectural planning (3-4 months)

- Engineering plans development (2-3 months)

- Municipality approval process (5-9 months)

- Capital Deployed: Additional 10-15% of total investment

- Construction Phase (18-30 months):

- For Tama 38/1: Construction while residents remain (18-24 months)

- For Tama 38/2: Demolition and reconstruction (24-30 months)

- Capital Deployed: Remaining 65-75% of total investment

- Critical Approval-Stage Risk Factors:

- Average approval delays in Jerusalem: 4.2 months

- Historical rate of significant plan modifications required: 65%

- Projects requiring special variances: 70% (particularly in central neighborhoods)

Advanced Investment Strategies: Limited Partnership Structures

The Jerusalem market has developed sophisticated investment vehicles for Tama 38:

- Project-Specific Limited Partnerships:

- Typical minimum investment: ₪1-2 million

- Expected returns: 18-25% IRR over 3-4 years

- Investor protection mechanisms: staged capital calls, priority returns

- Legal structure: typically offshore vehicles for international investors

- Multi-Project Tama 38 Funds:

- Portfolio approach spreading risk across 4-8 concurrent projects

- Minimum investment thresholds: ₪3-5 million

- Target returns: 15-20% IRR with lower volatility

- Geographic diversification across multiple Jerusalem neighborhoods

- Hybrid Financing Structures:

- Debt-equity hybrid models providing 8-12% fixed returns plus profit participation

- Mezzanine financing with conversion rights securing investor positions

- Staged exit opportunities allowing partial liquidation during project lifecycle

Sophisticated Project Evaluation Framework

Professional investors utilize a multi-factor analysis methodology when evaluating potential Jerusalem Tama 38 projects:

Primary Evaluation Criteria:

- Location Value Matrix:

- Premium Tier (Rehavia, Talbieh, German Colony):

- Highest price points but narrowest margins (18-22%)

- Limited density bonuses due to preservation constraints

- Highest international buyer percentage (40-60%)

- Fastest absorption rates (3-6 months for new units)

- Mid-Tier Neighborhoods (Baka, Arnona, Old Katamon):

- Balanced margins (20-25%)

- Stronger local buyer demand (60-70% primary residences)

- Moderate construction complexity

- Good value appreciation potential (6-8% annually post-completion)

- Value Tier (Kiryat HaYovel, Kiryat Menachem, Gilo):

- Lower absolute returns but higher percentage margins (25-30%)

- Higher density bonuses available (up to 3.5× original built area)

- Longer absorption periods (8-14 months)

- Higher sensitivity to market fluctuations

- Premium Tier (Rehavia, Talbieh, German Colony):

- Building Structural Assessment:

- Professional engineering evaluation costs: ₪15,000-30,000 per building

- Critical factors determining Tama 38/1 vs. 38/2 viability:

- Foundation condition and earthquake resistance

- Structural system integrity (particularly in pre-1980 buildings)

- Presence of hazardous materials requiring special remediation

- Jerusalem-specific challenges:

- Rocky terrain requiring specialized foundation solutions

- Historical construction methods with inconsistent quality

- Limited documentation for many older structures

- Tenant Composition Analysis:

- Optimal Resident Profiles:

- Buildings with 70%+ owner-occupants versus renters

- Higher percentage of long-term residents (10+ years in building)

- Demographic homogeneity facilitating consensus

- Decision-Making Dynamics:

- Legal requirement: 80% owner approval for Tama 38/2 projects

- Practical consensus threshold: 90%+ for smooth project execution

- Critical project delays from resident disputes: average 7-12 months

- Resident Incentive Structures:

- Custom compensation packages based on apartment size/location

- Special provisions for elderly or vulnerable residents

- Temporary relocation solutions for Tama 38/2 projects

- Optimal Resident Profiles:

- Regulatory Navigation Expertise:

- Jerusalem Municipality Districts:

- Each district has separate planning committees and approaches

- Processing times vary by district (Central: 14-18 months, Peripheral: 10-14 months)

- Critical Approval Factors:

- Parking solutions (particularly challenging in central neighborhoods)

- Heritage preservation requirements

- Public space contributions

- Infrastructure capacity assessments

- Strategic Navigation Approaches:

- Pre-submission consultations with district planners

- Phased approval strategies for complex projects

- Strategic use of appeals processes for challenged decisions

- Collaboration with resident representatives throughout approval process

- Jerusalem Municipality Districts:

Risk Mitigation Strategies for Tama 38 Investors

Sophisticated investors in Jerusalem’s Tama 38 market employ several risk management approaches:

- Project Insurance Frameworks:

- Professional liability coverage for design and engineering (₪5-10 million typical coverage)

- Construction completion guarantees (mandatory for most bank financing)

- Specific Tama 38 risk policies covering resident compensation obligations

- Delayed completion coverage mitigating expense overruns

- Structured Legal Protection:

- Special purpose vehicle (SPV) structures isolating project liabilities

- Graduated compensation schedules with resident milestone payments

- Conditional building rights acquisition protecting against approval failures

- Comprehensive force majeure provisions addressing Jerusalem’s unique geopolitical risks

- Phased Capital Deployment:

- Stage-gated investment with clear continuation criteria

- Separate financing tranches for planning and construction phases

- Pre-construction presales reducing exposure (typically 30-50% of new units)

- Syndication options for larger capital requirements

Challenges and Considerations: Navigating Jerusalem’s Complex Tama 38 Landscape

Regulatory Evolution and Transition Landscape

As Israel transitions from traditional Tama 38 to newer urban renewal frameworks, investors must understand the evolving regulatory environment specific to Jerusalem:

Current Regulatory Framework Status (2025)

- Official Program Status:

- Original national Tama 38 framework expired October 2022

- Jerusalem Municipal Extension Plan authorized through December 2025 for qualified projects

- “Grandfathering” provisions for projects with initial approvals already secured

- Jerusalem-Specific Tama 38 Adaptations:

- Jerusalem Local Plan 101-0465229 (the “Extended Tama Framework”)

- Special provisions for heritage neighborhoods (German Colony, Rehavia, Nahlaot)

- Modified approval pathways for priority development zones

- Integration with Jerusalem Master Plan 2040 urban renewal objectives

- Transition to Alternative Renewal Mechanisms:

- Pinui-Binui Light: Modified evacuation-reconstruction model with streamlined approval process

- “Jerusalem Renewal Track”: City-specific urban regeneration framework with enhanced rights

- Special Local Plans (Tochnit Nekudatit): Site-specific planning approvals with Tama-like incentives

- Jerusalem Urban Clusters Program: Block-level renewal with integrated public infrastructure

Navigating the Regulatory Transition

- Critical Documentation Requirements:

- Building rights verification through “Certification of Rights” (Ishur Zchuyot)

- Historical permit verification (particularly important for buildings with unclear permit history)

- Special requirements for buildings constructed before 1980

- Heritage status verification from Jerusalem Conservation Department

- Expert Guidance Necessities:

- Specialized Tama 38 legal counsel familiar with Jerusalem committees

- Urban renewal architects with municipality relationship history

- Project management teams with specific Jerusalem Urban Renewal Authority experience

- Community engagement specialists for resident negotiations

- Strategic Timing Considerations:

- Critical path permitting strategies optimizing approval timelines

- Strategic phasing of resident agreements and municipality submissions

- Coordination with parallel infrastructure projects (light rail, road improvements)

- Election cycle awareness (local elections can impact approval timelines)

Construction and Design Complexities Unique to Jerusalem

Jerusalem presents distinctive technical and design challenges requiring specialized approaches:

Technical Challenges

- Jerusalem Topography Impact:

- 70% of Tama 38 sites located on hillside terrain

- Complex foundation engineering requirements

- Retaining wall integration challenges

- Drainage and water management considerations in mountainous urban setting

- Historical Construction Limitations:

- Pre-1950s buildings often utilizing local limestone with variable quality

- Undocumented structural modifications common in older buildings

- Limited as-built documentation for buildings over 50 years old

- Heritage preservation balancing with modern structural requirements

- Infrastructure Integration Challenges:

- Aging municipal systems requiring upgrades beyond project boundaries

- Limited capacity in water, sewage, and power systems in older neighborhoods

- Coordination requirements with multiple infrastructure authorities

- Underground infrastructure mapping inconsistencies

Design and Preservation Balance

- Jerusalem Architectural Heritage Requirements:

- Jerusalem Stone façade requirements (municipal building code Article 74)

- Historical streetscape preservation guidelines

- Height and setback restrictions in heritage zones

- Traditional architectural element integration requirements

- Contemporary Design Integration:

- Successful case studies balancing heritage and modernization:

- Jaffa Road 167: Modern top floors with recessed profiles above preserved façade

- Azza Street 13: Glass and Jerusalem stone integration with historical elements

- Palmach Street 42: Contemporary interpretation of traditional architectural motifs

- Award-winning approaches recognized by Israel Architects Association

- Successful case studies balancing heritage and modernization:

- Technical Innovation Applications:

- Seismic reinforcement solutions preserving historical character

- Energy efficiency upgrades compatible with traditional building materials

- Smart building technologies integrated into heritage structures

- Acoustic isolation strategies for traditional construction

Parking and Urban Access Solutions

- Central Jerusalem Parking Challenges:

- Minimum parking requirements: 1.5 spaces per new unit

- Limited underground potential in rocky terrain

- Heritage restrictions limiting visible parking solutions

- Narrow street access constraining construction logistics

- Innovative Approaches Gaining Approval:

- Mechanical parking systems (increasing 30-40% annual adoption)

- Shared parking arrangements between adjacent projects

- Car-sharing integration reducing parking requirements by 15-20%

- Special variances for projects near public transportation hubs

- Financial Implications of Parking Solutions:

- Underground parking construction costs: ₪200,000-300,000 per space

- Mechanical systems: ₪150,000-220,000 per space

- Parking solution impact on overall project ROI: typically 3-5% reduction

- Strategic mitigation through higher-value unit design optimizing remaining space

Community and Social Dimension of Jerusalem Tama 38

Successful Jerusalem projects increasingly address the social fabric beyond physical construction:

Community Integration Best Practices

- Resident Involvement Frameworks:

- Structured resident committees with decision-making protocols

- Transparent communication systems throughout project lifecycle

- Regular community meetings with visual progress updates

- Dedicated resident liaison officers for larger projects

- Diverse Community Needs Accommodation:

- Multi-generational design considerations

- Religious community requirements integration (Shabbat elevators, sukkah balconies)

- Accessibility enhancements beyond code requirements

- Community space provisions in larger developments

- Social Cohesion Preservation Strategies:

- Phased construction minimizing community disruption

- Temporary facilities during construction phases

- Community continuity planning for demolition/reconstruction projects

- Post-completion community reintegration programs

The Future of Urban Renewal in Jerusalem: Trends, Innovations, and Investment Horizons

While Tama 38 in its original form is gradually being replaced with newer frameworks, Jerusalem’s urban renewal landscape continues to evolve rapidly. Forward-looking investors are positioning for the next generation of opportunities in Israel’s capital city.

Emerging Urban Renewal Frameworks and Opportunities

The post-Tama 38 landscape is taking shape with several structured alternatives gaining traction:

1. Jerusalem-Specific Urban Renewal Programs

- The Jerusalem Model: The municipality has developed its own urban renewal framework (Plan 101-0465229) providing:

- Enhanced building rights in designated “Urban Intensification Corridors”

- Streamlined approval processes for projects meeting pre-defined parameters

- Integration with transportation and infrastructure planning

- Special provisions for neighborhoods with character preservation requirements

- Block-Level Renewal Incentives:

- The “Urban Block Regeneration Program” offers significant additional rights for developers undertaking entire block renewals

- Density bonuses of up to 300% above existing rights in priority development zones

- Special fast-track approvals for qualifying projects

- Public infrastructure integration requirements with developer contributions

2. Light Rail Corridor Development Opportunities

- Transit-Oriented Development Zones:

- Special planning designations within 500m of light rail stations

- Height restrictions relaxed by 3-5 stories in these zones

- Reduced parking requirements (30-50% below standard)

- Mixed-use incentives with commercial ground floors

- Case Study: Jaffa Road Corridor:

- 28 buildings undergoing simultaneous renewal along light rail route

- Coordinated planning creating unified urban experience

- Property value premiums of 25-35% for transit-adjacent projects

- Emerging micro-neighborhoods around station areas

3. Public-Private Partnership Models

- Jerusalem Urban Renewal Authority Partnerships:

- Municipality equity participation in strategic projects

- Public land contributions enhancing project viability

- Streamlined approvals for qualifying partnerships

- Risk-sharing structures attracting institutional investors

- Social Housing Integration Requirements and Opportunities:

- Minimum 10% affordable housing allocations in larger projects

- Tax incentives for developers exceeding affordable housing targets

- Cross-subsidization models maintaining project returns

- Creating socially sustainable neighborhoods with diverse resident profiles

Technological Innovations Reshaping Jerusalem’s Urban Renewal

The next generation of urban renewal projects in Jerusalem is incorporating cutting-edge technologies that create investment differentiation and enhance returns:

1. Smart Building Integration in Historical Contexts

- Heritage-Compatible Smart Systems:

- Wireless systems minimizing intervention in historical structures

- Non-invasive monitoring and control technologies

- Energy management systems reducing costs by 25-40%

- Remote management capabilities attractive to international owners

- Security Innovation Applications:

- Advanced but discreet security systems suitable for heritage buildings

- Biometric access integrated with traditional aesthetics

- Community-wide security networks in renewal clusters

- Emergency response systems with municipal integration

2. Sustainability Features Gaining Market Premium

- Jerusalem Climate-Specific Solutions:

- Passive solar design optimized for Jerusalem’s climate zones

- Natural ventilation systems reducing energy requirements

- Advanced insulation within traditional building envelopes

- Rainwater harvesting and graywater systems addressing water scarcity

- Financial Returns on Sustainability Investments:

- Energy-efficient buildings commanding 10-15% rental premiums

- Operational cost reductions of ₪400-600 per month per unit

- Faster absorption rates for green-certified projects

- Growing investor mandate requirements for sustainability features

3. Construction Technology Advancements

- Modular Components Reducing Project Timelines:

- Prefabricated elements compatible with heritage requirements

- 20-30% reduction in construction timelines

- Quality control improvements reducing post-completion issues

- Cost efficiencies of 7-12% on larger projects

- Advanced Seismic Protection Systems:

- Next-generation damping technologies

- Performance beyond code requirements attracting premium buyers

- Insurance premium reductions for advanced implementations

- Marketable safety features resonating with international purchasers

Investment Strategy Evolution for Jerusalem’s Urban Renewal Market

As the regulatory framework evolves, sophisticated investors are adapting their approaches to the Jerusalem market:

1. Portfolio Diversification Across Renewal Types

- Balanced Project Portfolio Structures:

- 30-40% allocation to secure central neighborhood projects

- 40-50% to mid-tier neighborhoods with higher margins

- 10-20% to emerging areas with higher risk/return profiles

- Geographic diversification across multiple municipal planning districts

- Project Type Diversification:

- Mix of reinforcement projects with faster returns

- Reconstruction projects with higher long-term yields

- Combination of residential and mixed-use developments

- Strategic participation in larger coordinated block renewals

2. Capital Structuring Innovations

- Layered Investment Vehicles:

- Separation of development and long-term holding strategies

- Mezzanine financing with conversion rights

- Preferred equity structures with IRR hurdles

- International investor syndication platforms

- Risk Mitigation Through Structure:

- Strategic use of insurance products covering approval risks

- Completion guarantees through specialized urban renewal policies

- Phased capital calls matching project milestones

- Special provisions for Jerusalem-specific risks (security, political)

3. Exit Strategy Optimization

- Strategic Holding Period Determination:

- Immediate post-completion sales capturing premium pricing

- 3-5 year holds benefiting from neighborhood transformation value increases

- Long-term income generation from select premium properties

- Mixed strategies optimizing tax treatment and market timing

- Emerging Liquidity Channels:

- REIT participation in completed urban renewal assets

- Institutional investor appetite for stabilized renewal portfolios

- International buyer networks specifically targeting Jerusalem renewal projects

- Specialized urban renewal funds providing developer exits

Future Jerusalem Neighborhoods Poised for Renewal

While current activity focuses on established areas, forward-looking investors are identifying the next wave of Jerusalem neighborhoods with renewal potential:

1. Emerging Opportunity Zones

- Northern Jerusalem Corridors:

- Ramat Eshkol to French Hill corridor following light rail expansion

- Aging housing stock approaching optimal renewal timing

- Infrastructure improvements enhancing accessibility

- Relatively affordable acquisition costs with strong upside potential

- Southern Growth Areas:

- Gilo and Armon Hanatziv renewal programs gaining momentum

- Municipal incentives for development in priority southern zones

- Improved transportation connections enhancing desirability

- Significant value gap potential between current and post-renewal pricing

2. Commercial-to-Residential Conversion Opportunities

- Office Building Transformation Potential:

- Aging office inventory in central areas suitable for conversion

- Special municipality provisions for change-of-use projects

- Premium pricing potential for centrally-located residential units

- Mixed-use potential maintaining ground floor commercial

- Industrial Zone Regeneration:

- Talpiot industrial area gradual transition to mixed-use

- Special planning designations encouraging residential integration

- Creative-class clustering creating vibrant urban environments

- Strategic land banking opportunities ahead of zone transitions

3. Long-Term Strategic Vision Areas

- Western Jerusalem Expansion Zones:

- Municipality master plan designating western growth corridors

- Strategic land assembly opportunities ahead of infrastructure development

- Long-term appreciation potential as city expands westward

- Infrastructure planning already underway for future development

- Urban Centers Beyond The Core:

- Secondary neighborhood centers designated for intensification

- Transit hub development plans enhancing future accessibility

- Affordable entry points with 7-10 year investment horizons

- Early-stage approval processes for master planned development

Conclusion: Jerusalem’s Urban Renewal Renaissance – Strategic Positioning

Despite regulatory changes, Jerusalem continues to offer exceptional opportunities for urban renewal investments. The combination of strong demand, limited supply, and the city’s enduring appeal creates a resilient market for well-executed projects. The evolution beyond traditional Tama 38 towards more comprehensive renewal frameworks opens new possibilities for investors willing to navigate the complexity.

The most successful participants in Jerusalem’s urban renewal landscape share several common characteristics:

- Deep Local Knowledge: Understanding Jerusalem’s unique neighborhoods, planning processes, and market dynamics

- Relationship Networks: Strong connections with residents, municipality officials, and service providers

- Technical Expertise: Specialized knowledge in heritage integration, complex engineering, and Jerusalem-specific construction practices

- Patience and Vision: Willingness to navigate extended timelines with confidence in the enduring value proposition

- Financial Sophistication: Creative approaches to project financing, risk management, and value optimization

For investors considering this market, Jerusalem’s urban renewal sector rewards those who combine thorough due diligence with a genuine appreciation for the city’s distinctive character. As the capital city continues its careful balance of preservation and renewal, those who contribute thoughtfully to its evolution stand to create both significant value and meaningful urban legacy.

This blog post is intended for informational purposes only and does not constitute investment advice. Potential investors should conduct their own research and consult with legal and financial professionals before making investment decisions regarding Tama 38 or other real estate projects in Jerusalem.