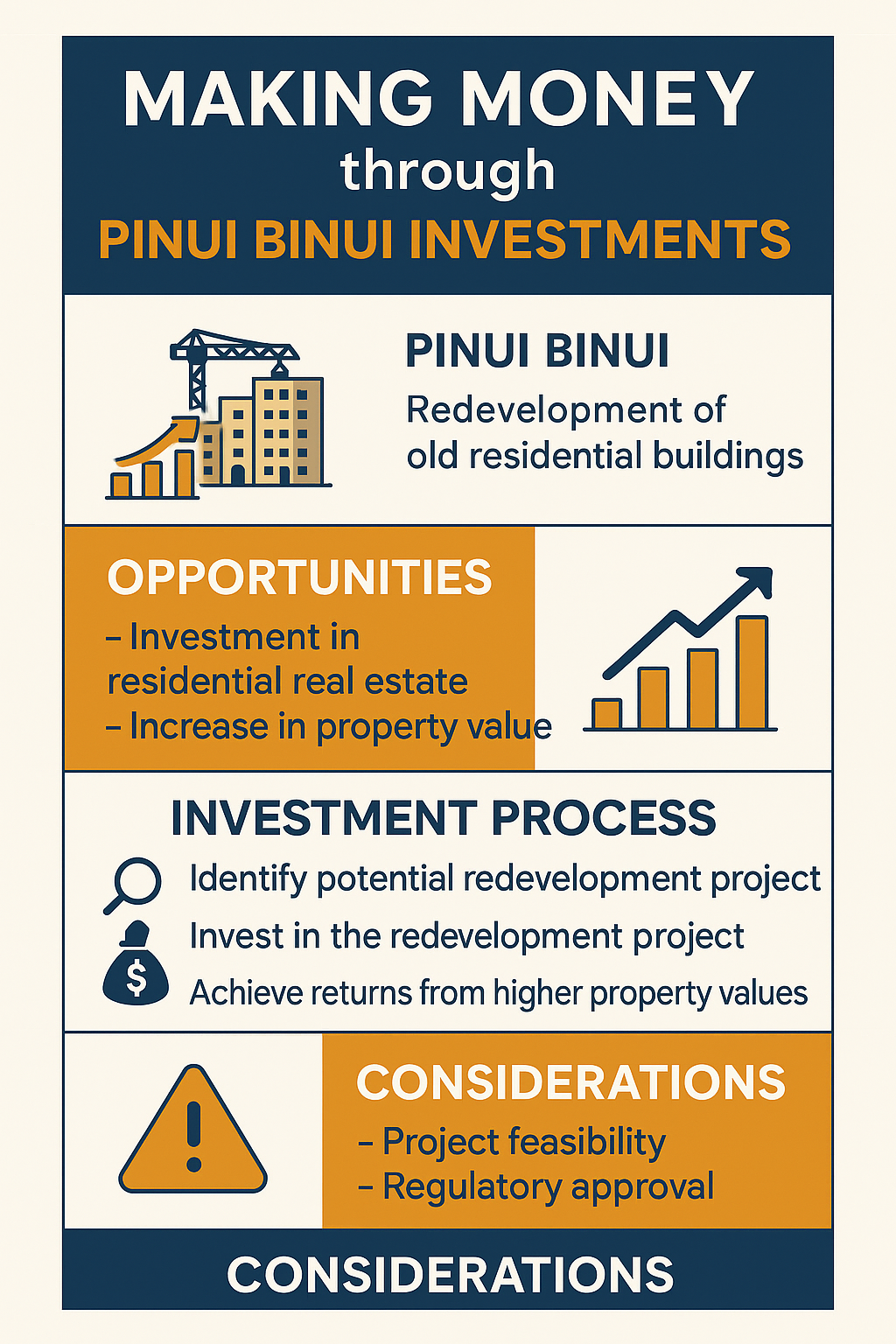

Investing in Pinui Binui (urban renewal) projects can be potentially lucrative, especially in the Israeli real estate market where housing demand continues to rise in urban centers. These projects involve demolishing older, typically smaller buildings and replacing them with modern residential complexes that offer more units and improved facilities.

One of the most direct approaches to profit from Pinui Binui is by purchasing an apartment in a building designated for renewal. When you own property in such a building, developers often offer generous compensation packages – either in the form of a much larger apartment in the new building (typically 25-40% larger than your original unit) or a substantial cash payout. The value proposition is clear: you trade your older, smaller apartment for a brand new, larger one in the same location, potentially gaining hundreds of thousands of shekels in property value.

For those with more significant investment capital, becoming a developer or partnering with development companies represents another pathway. Developers who successfully navigate the complex approval process and tenant negotiations can achieve substantial returns, though this requires specialized knowledge, connections, and typically millions of shekels in initial investment. The profit margins for developers can be significant as they leverage the additional building rights granted in these projects.

Alternatively, you might consider investing in publicly traded real estate companies that specialize in urban renewal projects. This provides exposure to the Pinui Binui market without requiring direct property ownership or development expertise. Many Israeli construction and real estate companies have dedicated divisions focused on these lucrative urban renewal opportunities.

Timing is crucial in Pinui Binui investments. The early stages of a project – when plans are just being formed and before most apartment owners understand the potential value – often represent the best entry points for investors. Purchasing apartments in buildings with renewal potential before prices reflect that potential can lead to substantial gains once the project gains momentum and approaches approval.

However, these investments come with significant risks that should not be underestimated. Pinui Binui projects are notorious for lengthy timelines, often taking 5-10 years from initial planning to completion. Regulatory hurdles, securing tenant agreements (typically 80% minimum consent is required), and fluctuating market conditions all present challenges. Many projects that seem promising initially never reach completion due to these obstacles.

Success in this investment arena requires thorough due diligence, patience, and ideally guidance from professionals who understand the nuances of urban renewal regulations and market dynamics. Consulting with attorneys who specialize in real estate law, particularly Pinui Binui legislation, is essential before making significant investments in this sector.

For those willing to navigate these complexities, Pinui Binui investments offer a unique opportunity to capitalize on Israel’s ongoing urban transformation and address the persistent housing shortage in high-demand areas, potentially delivering returns that outpace traditional real estate investments.